south dakota property tax exemption

A Solar PV system can increase the value of your home by a multiple of 20 times your annual electricity savings a 5kW. Restaurants In Matthews Nc That Deliver.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

South Dakota Codified Laws 43-31.

. The property has to be their principal residence. Owner-occupied classification historical moratorium paraplegic reduction of taxes paraplegic and disabled veteran exemption and the various exemptions for religious organizations charities and schools. Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes.

South Dakota is ranked number twenty seven out of the. On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. South Dakota has replaced all exemp-tion certificates with the Streamlined Exemption Certificate.

The state gets a good amount of sun throughout the year and solar panel module prices continue to fall. How are South Dakota property taxes calculated. South Dakota property tax credit.

Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Public schools including K-12 universities and technical institutes that are supported by the State of South Dakota or. Majestic Life Church Service Times.

Tax Breaks and Reductions State law provides several means to reduce the tax burden of senior citizens. 128 of home value. Property tax rates are a little bit higher averaging 1 to 1 12 of the home value.

South dakota is one of 38 states that does not levy or assess an estate tax. Wind solar biomass hydrogen hydroelectric and geothermal systems used to produce electricity or energy are considered renewable resource systems. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property.

Additionally the disability has to be complete and 100 related to military service. There are two sections in the South Dakota Constitution that provide property tax exemptions. Appropriate communication of any rate hike is also a requisite.

What the Program Does Eligibility How to Apply Contact Us 1-800-829-9188 proptaxinstatesdus httpsdorsdgov. South Dakota is a decent place to install home solar panels but not due much to the effort of state lawmakers here outside of a property tax exemption. The state lacks a Renewable Portfolio Standard which is a law that establishes a minimum renewable generation percentage for utility companies subject to a.

Summary of South Dakota solar incentives 2022. Are Dental Implants Tax Deductible In Ireland. The State of South Dakota recognizes and honors our states veterans for the service they have given to and sacrifices they have made for their country.

South Dakota Property Tax Exemption. Certain South Dakota citizens qualify for property tax relief programs. South Dakota offers a full property tax exemption to eligible paraplegic Veterans and their Surviving Spouse.

43-31-38 Prohibited property taxes as a lien on property--Interest. South Dakota property taxes are based on your homes assessed value as determined by the County Director of Equalization. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing and needs no statutory language to put the.

South Dakota Solar Power Incentives Tax Breaks and Rebates. South Dakota does not even have an income tax. With no estate tax no inheritance tax and no.

The unmarried spouse of an eligible veteran. Article XI 5 provides a. Property Tax Exemption for Disabled Veterans.

Application for the. There are two main incentives for solar power in South Dakota. For the certificate to be valid.

A South Dakota Property Records Search locates real estate documents related to property in SD. The 30 federal tax credit and the 70 property tax exemption after you install a solar PV system. Income Tax Rate.

As you can tell South Dakota is a very good place to live from a tax standpoint. Property Tax Exemption Program Whats inside. The dwelling must be owned and occupied by the veteran.

Tax amount varies by county. Is the above described property classified in the county director of equalization office as owner-occupied. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities.

SDCL 10-4-40 and 10-4-41states that 150000 of the full and true value of a dwelling that is owned and occupied by a veteran who is rated permanently and totally disabled from a service connected disability ies is exempt from taxation. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax SDCL 10-4-42 to 10-4-45. Calling the Sioux Falls VA Regional Office at 1-800-827-1000 and asking them to send you a statement.

The states laws must be adhered to in the citys handling of taxation. CHAPTER 43-31 HOMESTEAD EXEMPTION 43-31-1 Homestead exempt from judicial sale judgment lien and mesne or final process--Mobile homes--Senior citizens. The continuous exemption applies to the first 50000 or 70.

A properly completed exemption certificate has the following information. But the state does have a variety of programs for senior citizens to reduce that tax. Taxation of properties must.

Property tax exemptions allow businesses and homeowners to exclude the added value of a system from the valuation of their property for taxation purposes. Exempt property but is not completely accurate due to inconsistencies in the manner in which the property is valued and reported. South Dakota offers property tax exemptions for installed solar systems.

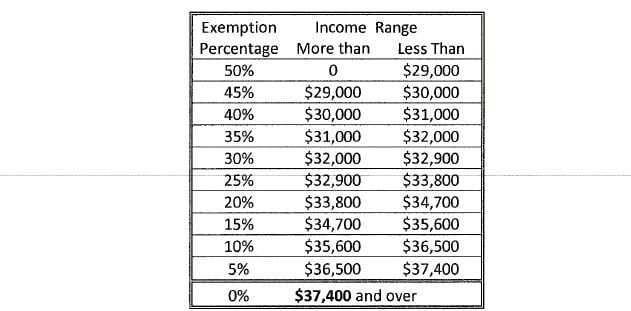

Some of our South. The property subject to this exemption is the same property. Sales and property tax refunds and property tax freezes are available to seniors who meet the qualifications.

Restaurants In Erie County Lawsuit. South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. South Dakota Property Tax Exemption.

This exemption applies to the house garage and the lot up to one acre. This program exempts up to 150000 of the assessed value for qualifying property. Constitutional Provisions There are two sections in the South Dakota Constitution that provide property tax exemptions.

Pennington county has one of the highest median property taxes in the united states and is ranked 447th of the 3143. Opry Mills Breakfast Restaurants. Such proof can be obtained by.

July 2013 South Dakota Department of Revenue 445 East Capitol Avenue Pierre South Dakota 57501 Exemption Certificate. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted.

See program descriptions and learn if you qualify for property tax exemptions. SDCL 10-4-2410 SDCL 10-4-2411. All applicants must provide proof of their eligibility for this exemption.

State of South Dakota and public or municipal corporations of the State of South Dakota. South Dakota Property Tax Exemption for Paraplegic Veterans and Their Surviving Spouse. There are about 5800 parcels of exempt property listed in the table.

The Equalization Department is also responsible for administering various tax reduction or tax exemptions specified in South Dakota law.

Property Taxes Calculating State Differences How To Pay

Understanding Your Property Tax Statement Cass County Nd

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Colorado S Low Property Taxes Colorado Fiscal Institute

Property Taxes By State In 2022 A Complete Rundown

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

Property Taxes Calculating State Differences How To Pay

Understanding Your Property Tax Statement Cass County Nd

Property Tax Definition Property Taxes Explained Taxedu

Property Taxes By State In 2022 A Complete Rundown

Solar Property Tax Exemptions Explained Energysage

Property Tax South Dakota Department Of Revenue

Property Tax Homestead Exemptions Itep

Property Tax Bills In Winnebago County Have Been Mailed Out Partial Payments To Be Accepted News Wrex Com

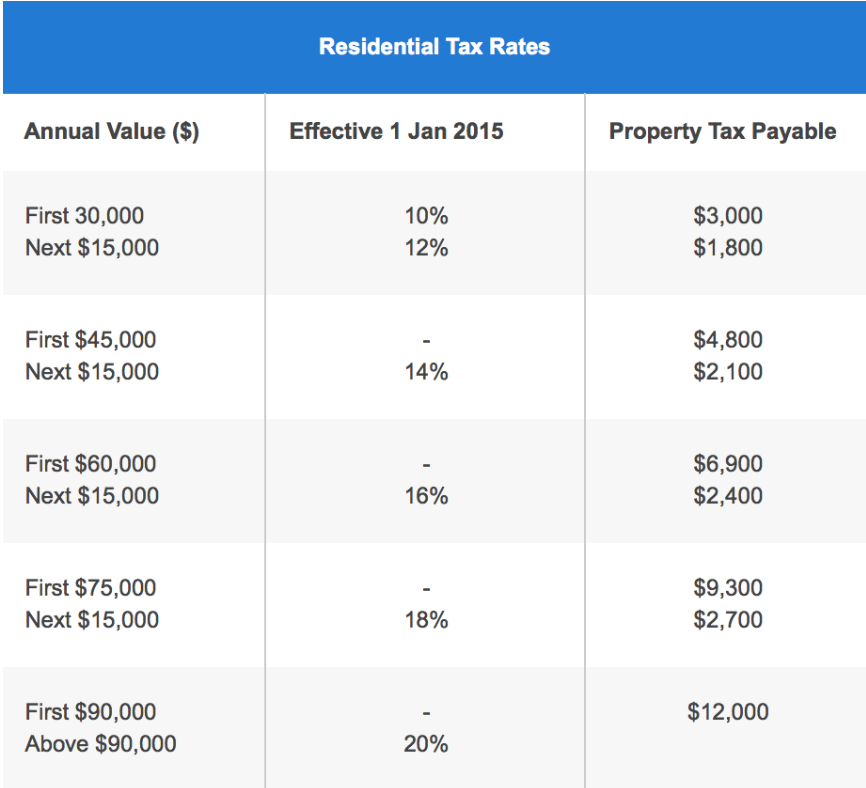

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Relief Programs South Dakota Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/MUTCLK5D7JGCTIDI6PJRO3E22I.jpg)

Deadline Approaching For Elderly Disabled South Dakotans To Apply For Property Tax Relief

Property Tax Prorations Case Escrow

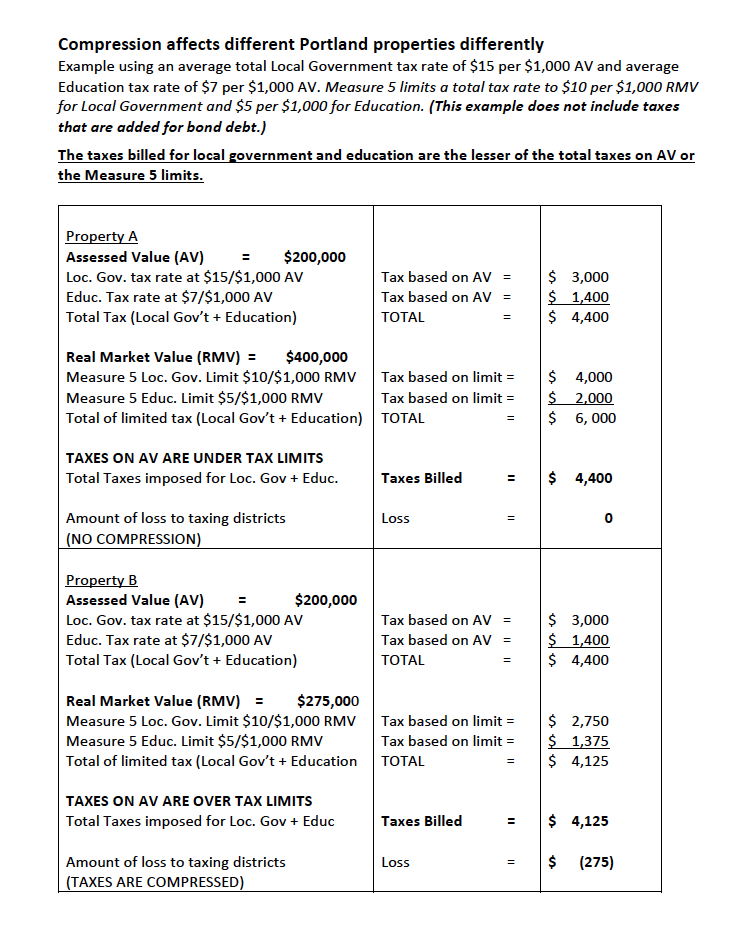

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland