utah non food tax rate

The Utah UT state sales tax rate is 47. Date Range Tax Rate.

Lgbt Black Elders In The South Wow In 2009 Alexis Pauline Gumbs Jula Wa Be An Ally Gender Lgbtq Marriage Families Sexualities Think Pinte

Monday - Friday 800 am - 500 pm.

. Local-level tax rates may include a local option up to 1 allowed by law. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or. Both food and food ingredients will be taxed at a reduced rate of 175.

January 1 2018 December 31 2021. January 1 2022 current. Counties and cities can charge an additional local sales tax of up to 24 for a maximum.

93 rows This page lists the various sales use tax rates effective throughout Utah. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state. All earnings are taxed at the same rate regardless of total income.

Start filing your tax return now. The state sales tax rate in Utah is 4850. In the state of Utah the foods are subject to local taxes.

As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. Utah has a single tax rate for all income levels as follows. Utah has recent rate changes Thu Jul 01 2021.

271 rows Utah has state sales tax of 485 and allows local governments to collect a local. With local taxes the total sales tax rate is between 6100 and 9050. Utah Tax Brackets for Tax Year 2021.

Utah non food tax rate Thursday June 16 2022 Edit. Depending on local jurisdictions the total tax rate can be as high as 87. Utah Tax Brackets for Tax Year 2020.

Detailed Utah state income tax rates and brackets are available on this page. With local taxes the total sales tax rate is between 6100 and 9050. Here you can find how Utah based income is taxed at a flat rate.

However in a bundled transaction which. 100 East Center Street Suite 1200 Provo Utah 84606 Phone. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

TAX DAY IS APRIL 17th - There. Utah has a flat income tax of 495.

Our Jozi Love City Of Gold Wedding Concept Ninirichi Style Studio Bunny Chow African Cooking African Food

How Do Food Delivery Couriers Pay Taxes Get It Back

The Rules On Sales Taxes For Food Takeout And Delivery

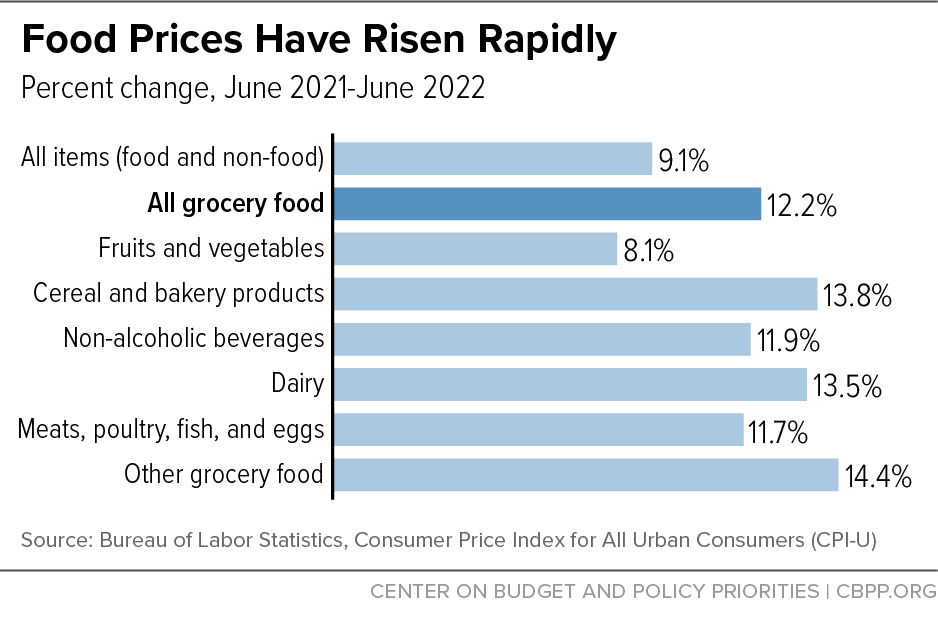

Snap Benefit Adjustments Will Help Low Income Households Cope With Food Inflation Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax On Grocery Items Taxjar

Utah Sales Tax Rates By City County 2022

Is Food Taxable In Utah Taxjar

Free Consultention Today We Provide Best Legal Services India Like Gst Outsourcing Import Export Code Trademark A Business Valuation Trademark Registration Coding

Free Consultention Today We Provide Best Legal Services India Like Gst Outsourcing Import Export Code Trademark A Business Valuation Trademark Registration Coding

Customer Acquisition Cost Calculator Plan Projections Financial Modeling Accounting And Finance How To Plan